Webinar | February 26th, 2026 | 3pm CET

Supervisory Expectations for AML/KYC Quality in 2026 and Beyond

Insights and best practices

What we'll cover

Financial institutions are under increasing pressure to strengthen AML/CFT frameworks while ensuring proportionality and avoiding unintended discriminatory effects. In this live webinar session with Arend Koper, we explore how supervisors assess whether institutions strike the right balance between effectiveness, risk focus, and fairness.

Key focus areas:

-

Placing the ML/TF risk assessment at the center of the AML/CFT risk management framework

-

Prioritizing top risks and allocating resources where they have the greatest impact

-

Ensuring explainability and clear rationale behind AML/CFT decisions and controls

You will gain insight into how supervisors evaluate the quality and effectiveness of AML/CFT controls, what they look for during onsite and offsite supervision, and why explainability of decisions and models has become essential.

The session also highlights common weaknesses identified during supervisory reviews and thematic examinations, helping participants understand where institutions most often fall short and how expectations are evolving.

Who should attend

This webinar is relevant for compliance leaders, AML/CFT professionals, risk managers, and senior stakeholders involved in financial crime risk management and regulatory interactions.

Meet the Speakers

-modified.png?width=250&height=250&name=Morten%20H%C3%B6her%20(2)-modified.png)

As an Account Executive at Sinpex, Morten supports financial institutions in bringing frictionless KYC/KYB compliance into day-to-day operations. Sinpex's AI extracts and verifies data directly from primary sources, maps ownership structures (UBO), and unifies onboarding, risk and AML checks, and ongoing monitoring in one seamless flow. As part of his role, Morten guides clients in streamlining processes, reducing manual workloads, and strengthening regulatory confidence with a future-proof compliance setup.

What's it about?

How supervisors really judge AML/CFT effectiveness, and where institutions most often fall short

Why explainability, clear rationale, and strong documentation are now non negotiable

What AMLA and new EU standards mean in practice, and how to prepare for 2026–2027 expectations

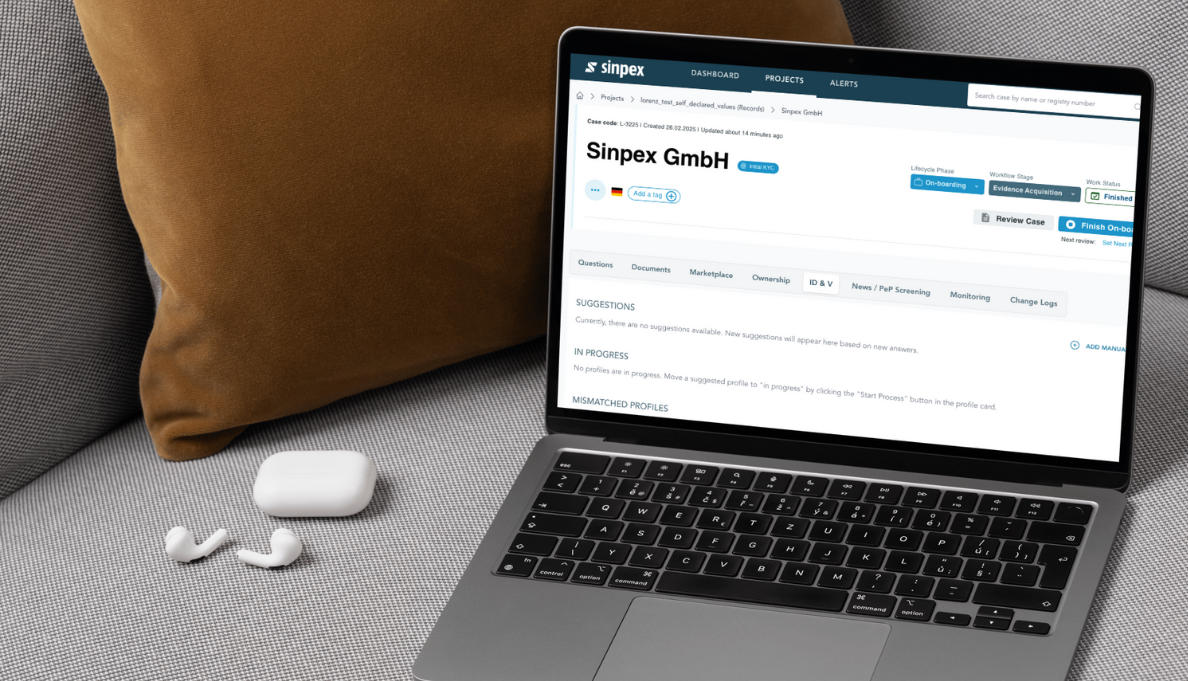

About Sinpex

At Sinpex, we believe KYB compliance isn’t just a necessity—it’s the foundation for secure and thriving businesses. By simplifying regulatory processes, we empower companies to build trust, ensure integrity, and unlock growth. In a fast-paced world, trust depends on speed, accuracy, and reliability. Sinpex turns KYC/KYB challenges into opportunities, enabling secure and scalable business growth without compromise. With deep industry expertise and a passion for progress, we deliver solutions that adapt, protect, and inspire trust in every client partnership.