SURVEY RESULTS 2025

EU AML Package

Readiness, Challenges and the Road Ahead

How prepared are European companies for the new EU AML Regulation?

Our joint study with Deloitte captures insights from almost 120 organizations across banking, insurance, consulting, industry, and real estate. It reveals where firms stand on readiness, what challenges they face — and how technology can bridge the compliance gap.

Key findings include:

-

47% of companies are still unfamiliar with the new EU AML requirements — revealing a major awareness and readiness gap ahead of the 2027 deadline.

-

Just 29% have started implementation, showing that most companies are still in the early stages of adapting to the regulation.

-

On average, 4.5% of annual revenue is expected to be spent on AML implementation — with wide variation by sector and company size.

-

1 in 5 companies anticipates spending over 70 internal hours per month on AML — highlighting the resource intensity of compliance.

-

While 53% already use digital AML tools, 51% are open to further automation — especially in finance, where openness rises to 62%.

Download the full study and see how your organization compares.

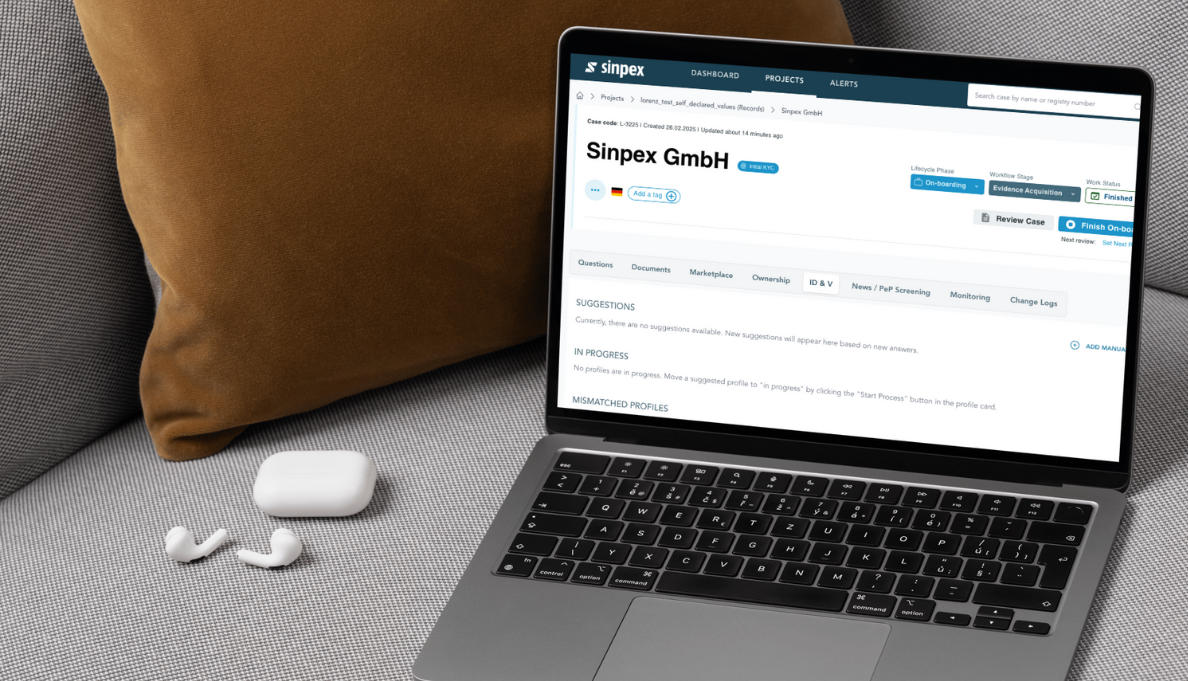

About Sinpex

At Sinpex, we believe KYB compliance isn’t just a necessity—it’s the foundation for secure and thriving businesses. By simplifying regulatory processes, we empower companies to build trust, ensure integrity, and unlock growth. In a fast-paced world, trust depends on speed, accuracy, and reliability. Sinpex turns KYC/KYB challenges into opportunities, enabling secure and scalable business growth without compromise. With deep industry expertise and a passion for progress, we deliver solutions that adapt, protect, and inspire trust in every client partnership.